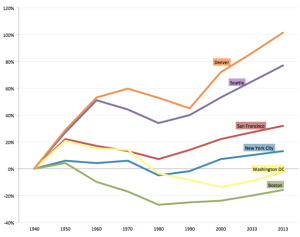

BeyondChron’s Randy Shaw takes exception to the conclusion of a recent op-ed by Gabriel Metcalf, president of SPUR. Metcalf draws a straight line from the 1980s to the present in San Francisco, indicting the progressive agenda, grown in this liberal microcosm, for ironically urging housing policies against its own long term self interest. “As the city got more and more expensive, progressive housing policy shifted gradually to a sad, rearguard movement to protect the people already here from being displaced.”

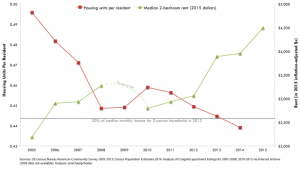

Metcalf sets this against a backdrop of a strong regional economy, with one of the “most powerful engine[s] of job creation in the country” located next door. And for that reason, he urges “A regional solution, in which all cities do their part to accommodate regional population growth [which] would be far more effective than trying to solve our affordability problems inside the boundaries of a handful of cities.” These days, the shortcoming of housing supply manifests in ways like San Francisco missing its affordable housing needs allocation by a mile.

Shaw, a lifelong advocate of the San Francisco progressive agenda, acknowledges the thoughtfulness of Metcalf’s analysis, but largely tracks two California state laws before attributing the problem to the California association of realtors. In 1996, the California legislature enacted Costa-Hawkins in response to the spread of vacancy control (which, at the time, was enacted in five California cities). Costa-Hawkins was implemented as a compromise, exempting certain kinds of units entirely, and other kinds of units under certain circumstances.

Shaw argues that a regime of vacancy control (i.e., a world where Costa-Hawkins never existed) would have had a more positive impact on housing affordability than, for instance, the production of all proposed housing units from the 1980s to present. (And, while the absolute price of those units would indeed be lower, this does seem to gloss over the anguish of fighting over listings, in a manner perhaps akin to vying for affordable and below market rate housing.)

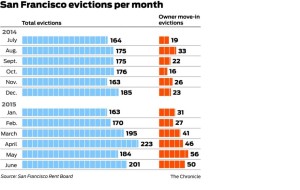

The second state law is the Ellis Act, which Shaw interprets as an eroding of the rent-controlled rental housing supply (particularly pernicious in neighborhoods like North Beach and the Castro where few affordable housing units are being built). However, unlike, e.g., condominium conversion or certain demolitions, the Ellis Act does not actually eliminate rent-controlled rental housing, functioning more like a five-year “reset button” on the rental rate.

That said, the Ellis Act and Costa-Hawkins certainly belong in any conversation about San Francisco’s housing crisis, where tenancies preserved at the lowest rents under the aegis of Costa-Hawkins essentially become targets for Ellis Act withdrawals. If rent-control reform is a necessary step toward mitigating the housing crisis, Ellis Act evictions will go down as the prices of long-term rent-controlled tenancies go up.