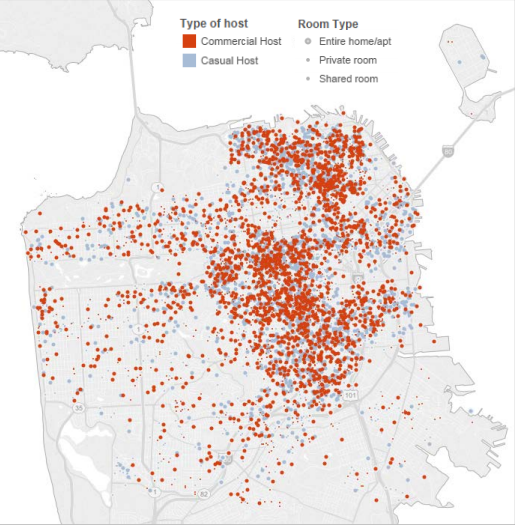

The use of Airbnb in San Francisco is becoming increasingly politicized in San Francisco. Earlier this year, the company paid a (somewhat voluntary) hotel tax, believed to be $25 million. However, while Airbnb’s CEO has urged that hosting has a de minimis impact on rental prices, a recent report by the Budget and Legislative Analyst’s Office suggests that the effect of the several thousand diverted units is significant.

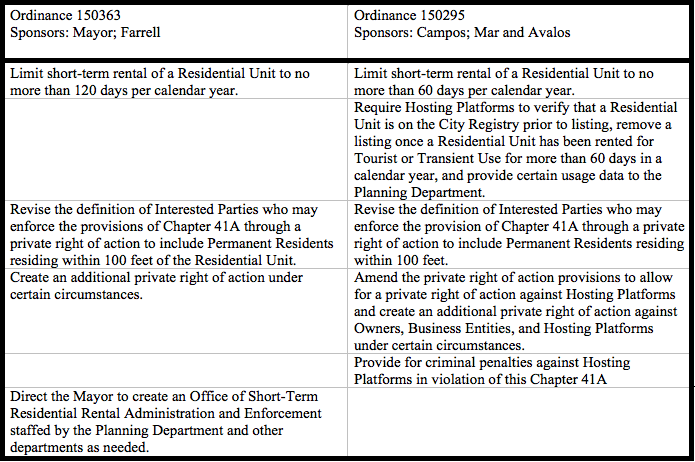

Two proposed amendments to the current law governing short-term rentals are competing to address the problem.

As compared to the current law, the version sponsored by Mayor Lee actually increases the allowable number of hosted days per year. Both versions seek to increase enforcement of the regulations, for example, by creating private rights of action and expanding the definition of “interested parties” who may sue to enforce. The main difference in enforcement is that the version sponsored by Supervisor Campos would put the burden on the hosting companies themselves, whereas the Mayor’s would create an Office of Short-Term Residential Rental Administration and Enforcement, specifically tasked with enforcement, which would take pressure off of the Planning Department.