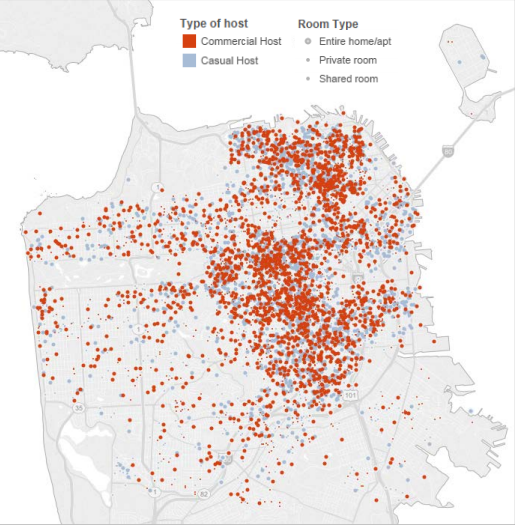

Supervisor Campos is receiving a lot of press lately for his unconventional position that may be heading to the ballot this November. In an effort to mitigate displacement of rent-controlled tenants in the Mission District, and address the SF housing crisis generally, he is aiming to impose a moratorium on market-rate housing developments in the Mission.

According to the San Francisco Business Times, Campos and his camp have a counterintuitive view of the affect of market-rate housing in the Mission. Of course more housing means less pressure on pricing. But they say “demand for housing in the Mission is so high that increasing supply will never push down prices. It only raises property values near new development, ripening the appetites of developers looking to make a bundle from developing more high-end condos and apartments”. In other words, gentrification is a domino effect.

Campos has plenty of political momentum on this issue. The SF Examiner reports 65% voter approval for a one-year moratorium, based on a recent poll. Last week, a mob of supporters flooded City Hall to demand a dialogue with Mayor Ed Lee, and apparently wanted him to declare a state of emergency to halt evictions in the Mission.

Even with all this energy, Campos’ measure could have a branding problem at the ballot box: he’ll need to convince all the voters who don’t live in the Mission that less housing means lower prices. This is a difficult task, to be sure – especially when his own colleague, Supervisor Weiner, thinks “his moratorium is an awful idea”.

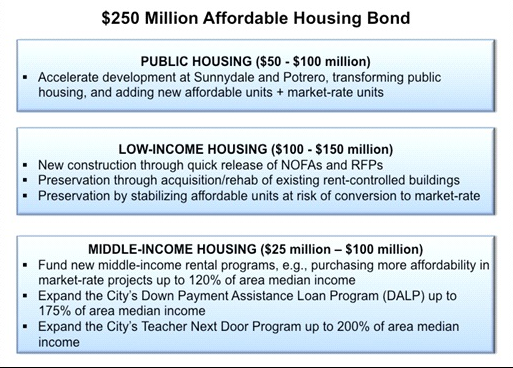

Economics aside, the goals of this effort may also a bit ironic. Existing development policy generally requires builders to create a certain number of inclusionary units. While Campos hopes the moratorium will buy time for the Planning Department to modify its inclusionary housing policy, others, like Edwin Lindo of the San Francisco Latino Democratic Club, apparently envision a market solution to emerge from the frozen market: “Our goal is not to stop all development. Our goal is to stop incredibly large development that focus exclusively on market-rate housing . . . We need a pause to ensure that if developers are going to build in our city they’re going to figure out a way to build affordable housing, even if that could be cutting into their 15 to 20 percent profit margins”.